Mobile banking is crucial for its convenience and accessibility, providing customers instant access to their accounts anytime, anywhere. It enhances efficiency, saves time, and offers personalized services, ultimately improving customer satisfaction.

Mobile banking promotes financial inclusion and ensures secure transactions through robust security measures. It also brings up considerable security and other challenges, as mobile banking requires a lot of private information to be accessible over the Internet.

The challenges make it imperative that the banking applications be tested to the highest quality standards.

Overview

Key Challenges in Mobile Banking Testing:

- Device and OS Fragmentation

- Network Variability

- Security and Compliance Risks

- Frequent Updates & Release Cycles

- High Transaction Loads

- Test Data Management

- Third-Party Integrations

- Accessibility & Inclusivity

Types of Mobile Testing for Banking Apps

- Functional Testing

- Usability Testing

- Performance Testing

- Security Testing

- Cross Browser Testing & Cross Platform Testing

- Accessibility Testing

- Regression Testing

This article explains the significance of mobile testing for banking applications, testing types, challenges, and more.

Importance of Technology in Banking and Mobile Apps

Technology has revolutionized the banking industry, enhancing efficiency, security, and customer experience. Mobile apps have become essential for seamless financial transactions, providing convenience and accessibility. Key benefits include:

- Convenience & Accessibility: Allows customers to perform transactions, check balances, and manage finances anytime, anywhere.

- Enhanced Security: Implements encryption, multi-factor authentication, and biometric security for fraud prevention.

- Automation & Efficiency: Reduces manual workload and streamlines banking operations through AI-driven chatbots and automated processes.

- Financial Inclusion: Expands banking access to underserved populations through digital solutions.

- Real-time Transactions: Enables instant fund transfers, bill payments, and digital wallet integrations.

- Regulatory Compliance: Helps banks adhere to industry standards and protect customer data.

- Seamless Third-party Integrations: Supports fintech collaboration and enhances banking services.

- AI & Predictive Analytics: Improves customer engagement with personalized financial insights.

How to Test Mobile Banking Applications and Websites?

With the growing adoption of digital banking, ensuring a smooth and secure experience across mobile applications is important.

To have successful mobile and web testing strategy make sure to include the following:

- Select various types of mobile devices(different brands, Android, iOS) and platforms such as iPads, Laptops, and Desktops to test on.

- Decide on browsers like the latest Google Chrome, slightly older Google Chrome, and an older version to see where the app breaks.

- Test on different versions of operating systems to see which OS the web and mobile are 100% not compatible with.

- Try to throttle mobile and other platforms to see where the application works best with 5G, 4G, EDGE…

- Remember to focus also on accessibility so that the app is socially apt on mobile and the web for a % of users.

Remember, if the mobile and web testing for banking applications are not done thoroughly, it can lead to negative publicity, loss of money, and reputation. It often results in legal issues and irreparable brand image damage.

Types of Mobile Testing for Banking Applications

Testing mobile banking applications requires a comprehensive approach to ensure reliability, security, and seamless user experience. Below are the critical types of testing necessary for mobile banking apps:

1. Functional Testing

Ensures core banking workflows operate seamlessly. This includes:

- Authentication & Authorization: Secure login, multi-factor authentication (MFA), biometric verification (Face ID, fingerprint).

- Fund Transfers & Payments: Domestic & international transfers, UPI, mobile wallets, bill payments.

- Card & Account Services: Card activation, blocking/unblocking, balance inquiries, loan applications.

- Alerts & Notifications: Real-time SMS, push notifications, and email updates for transactions & security warnings.

- Third-Party Integrations: Open banking APIs, payment gateways (Visa, Mastercard, PayPal), stock trading, and lending services.

2. Usability Testing

Banking apps must provide a frictionless and intuitive experience:

- Navigation & UI Design: Ensuring users can easily complete transactions with minimal steps.

- Form Validations & Error Handling: Proper messaging for incorrect PINs, expired cards, and failed transactions.

- Readability & Mobile Responsiveness: Optimized font sizes, color contrast, and layout adjustments for various devices.

- User Accessibility: Screen reader compatibility, high-contrast UI, and voice command navigation.

3. Performance Testing

Banking systems must handle high traffic loads, real-time transactions, and diverse network conditions:

- Load Testing: Ensuring seamless transaction processing during payday, Black Friday, or end-of-month periods.

- Stress Testing: Simulating peak demand scenarios (e.g., mass withdrawals during economic instability).

- Network Testing: Evaluating app behavior under networks like 5G, 4G, and low-bandwidth scenarios.

- Battery & Resource Consumption: Preventing excessive CPU and memory usage on mobile devices.

Read More: Load vs Stress Testing

4. Security Testing

Since financial transactions involve sensitive data, banking apps must be resilient to cyber threats:

- Data Encryption Testing: Ensuring transactions are encrypted end-to-end.

- Fraud Detection & Prevention: Identifying anomalies like unusual withdrawals, duplicate transactions, and account takeovers.

- Penetration Testing: Simulating hacking attempts to uncover security loopholes.

- Regulatory Compliance Testing: Verifying adherence to PCI DSS, GDPR, PSD2, Open Banking standards.

5. Cross Browser Testing & Cross Platform Testing

Banking apps must function across a diverse ecosystem:

- Operating Systems & Devices: Testing across iOS, Android, iPads, tablets, desktops with different OS versions.

- Browser Compatibility: Ensuring a consistent experience on Chrome, Safari, Edge, Firefox.

- Responsive Design Testing: Adjusting UI elements for foldable phones, tablets, and large-screen desktops.

6. Accessibility Testing

In a regulated industry like banking, accessibility is crucial:

- Screen Reader Support: Ensuring compatibility with VoiceOver (iOS) & TalkBack (Android).

- Keyboard Navigation: Making all functionalities accessible via keyboards or external assistive devices.

- Color Contrast & Font Adjustability: Optimized UI for visually impaired users.

7. Regression Testing

Frequent app updates demand thorough regression testing to prevent system failures:

- Automated Testing Pipelines: Running regression suites via Appium, Selenium, BrowserStack App Automate.

- Backward Compatibility Testing: Ensuring smooth performance on older OS versions and legacy devices.

- Patch Validation: Verifying bug fixes do not introduce new issues in banking workflows.

Read More: Top 20 Regression Testing Tools

Key Challenges in Mobile Banking Testing

Here are some of the challenges in mobile testing for Banks:

- Device and OS Fragmentation: Banking apps must function smoothly across a wide range of devices, operating systems, and screen sizes, requiring extensive compatibility testing.

- Network Variability: Performance must remain stable under fluctuating network conditions like 5G, 4G, and public Wi-Fi, ensuring uninterrupted transactions.

- Security and Compliance Risks: Strict regulatory requirements demand robust security testing to prevent data breaches, fraud, and unauthorized access.

- Frequent Updates & Release Cycles: Continuous app updates necessitate automated testing to maintain stability while introducing new features or security patches.

- High Transaction Loads: Apps must handle surges in transactions, particularly during peak banking hours, without performance degradation.

- Test Data Management: Simulating real-world banking scenarios without using sensitive customer data requires secure and compliant test data handling.

- Third-Party Integrations: External payment gateways, APIs, and financial data providers must be tested for security, reliability, and performance under real-world conditions.

- Accessibility & Inclusivity: Ensuring compliance with accessibility standards like WCAG and supporting assistive technologies to provide an inclusive experience for all users.

How to Onboard Teams into Mobile Testing

Even though everyone understands how crucial mobile testing is, it isn’t easy to onboard everyone to start testing on mobile devices, and the best way to onboard the team into Mobile testing is by following the following steps:

- Research Mobile testing and educate your teams

- Get buy-in from your stakeholders and understand how it fits with the company’s core values, the budget in place, and how we can showcase its benefits. Sometimes getting buy-in can result in tricky conversations. However, it is all about how and what information you present. So be ready with some stats and showcase what could happen if proper testing still needs to be implemented.

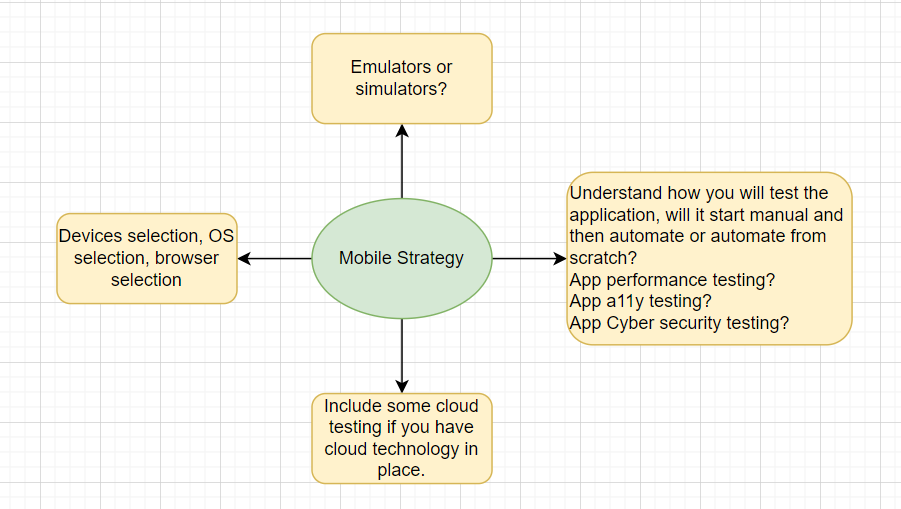

- Decide if you want to test Mobile web/hybrid native/pure native or everything.

- Research on a couple of tools, such as BrowserStack

- Ask the tooling company to provide Demo and some Q&A sessions to showcase what they can support the team with and what they can’t support.

- Build a strategy, even if it’s a draft to see what areas we can cover or have a phased approach, include all the right stakeholders, and use the strategy as a guide.

- Once the decision is made by the team and company wise and budgets are approved, the tool can be integrated.

- Teams should get training for the tool.

- Once the tool is embedded in the team(s), make sure to have some test plans so teams can test accordingly.

- Start with simple tests and grow the test stack.

When to Start Mobile Testing

To start with mobile testing, you need to have prior knowledge of software testing and some ideas about automation tools. It would be a great advantage if you have worked on any test automation tool. It is also essential to understand how the mobile works and its key requirements.

Understand what type of mobile testing you want to do, as well as there are some options. Mobile web applications, for instance, are when the website opens on a device (smartphone or tablet) with the help of a mobile browser. A native app is developed specifically for one platform (Android, iOS, Tizen, Windows 10 M0bile, BlackBerry). Finally, the Hybrid app mixes the Native App and Mobile Web App. It can be defined as mobile website content exposition in the application format.

No app should go live before it’s been mobile tested if your application is for mobile users. When you know the application is built for mobile devices, have a mobile testing strategy in place.

Options for your strategy:

How sensitive/privacy concerned the App testing should be in banking vs other sectors

Banks and financial institutions need to ensure all their applications are secure and no data is compromised. As we all know, data is a sensitive matter, whether that’s data of customers and financial issues from a bank or just your social media data.

Hence, the GDPR rules are in place and should be followed very thoroughly to avoid legal impediments. Similarly, Cyber security is a matter of concern too. It is vital to have Pentesting or some ethical hacking tests done to protect the customers and the bank itself.

A bank’s model/strategy is much more complex than other industries. Therefore we need to ensure the applications are built correctly and securely as they all get audited too.

BrowserStack has a great guide to testing banking apps and ensuring nothing is compromised. I have used Browserstack at a bank, which has provided the confidence a team needs to release an app.

More than 60% of global financial institutions with at least $5 billion in assets were hit by a variety of cyberattacks over the past year.

Mobile and web testing should be part of your testing strategy when you are aware that the product you are building will be customer-facing. Remember to understand what needs to be tested and how it can be tested in the right manner.

Especially with financial institutions, one should know the ins and outs of the application before committing to mobile testing, as any data lost or hacked can cause a major mishap. Banking is a complex world, and their software is not a simple app. Make sure to involve the right stakeholders from the very start and keep enhancing your testing stack with tools like BrowserStack.

Lastly, if we want to go live, it is better to have a solution in place to help improve complex systems, streamline the user experience, protect the users and the data as well as improve the performance of an application.

How BrowserStack helps in Mobile Banking Testing?

Banking applications require rigorous testing across multiple devices, operating systems, network conditions, and security protocols. Ensuring compatibility, performance, and compliance with regulatory standards can be complex.

BrowserStack’s App Live and App Automate provide a cloud-based, scalable testing solution to help banks deliver secure, high-performing mobile applications with minimal effort.

BrowserStack App Live

App Live enables interactive manual testing on a wide range of real iOS and Android devices without requiring an in-house device lab.

Key Benefits for Banking Apps

- Test on Real Devices: Validate app behavior across different models of iPhones, Samsung, Google Pixel, and other devices.

- Multi-OS & Browser Compatibility: Ensure seamless banking experiences across iOS, Android, Chrome, Safari, Firefox, and Edge.

- Network Simulation: Test application behavior under various network conditions, including 5G, 4G, 3G, and offline scenarios.

- Geolocation Testing: Test banking app behavior in different geographic regions to ensure compliance with local regulations.

- Debugging Tools: Capture logs, screenshots, and performance metrics for faster issue resolution.

BrowserStack App Automate

For banks implementing continuous testing and CI/CD pipelines, App Automate enables fast and parallel execution of automated tests across a fleet of real devices.

Key Benefits for Banking Apps

- Cloud-Based Automation: Run Appium, Espresso, and XCTest automation tests without managing physical devices.

- Parallel Testing: Execute tests across multiple devices simultaneously to reduce testing time.

- CI/CD Integration: Seamlessly integrate with Jenkins, GitHub Actions, Azure DevOps, and other CI/CD tools for automated testing in development workflows.

- Advanced Reporting: Access detailed analytics, logs, and video recordings to identify and resolve transaction failures.

- Secure Testing Environment: Enterprise-grade security ensures that financial data remains protected during testing. It also enables to be tested in local environments.

Future of Tech and Banking

As tech grows, the future of banking is looking bright. There are many trends in the banking world, such as Application programming interface (API) to make proprietary data available to anyone needing access. Many Fintech are using API technology to enable their businesses to function, and the success in this area is encouraging more Fintech to develop their APIs. AI is another big topic, and Banks are using this to make a customer’s identification and authentication process smoother while using employees through chatbots or even voice assistants.

According to an Insider Intelligence survey

- 66% of Banking Executives believe new technologies like blockchain, artificial intelligence (AI), and the Internet of Things (IoT) will significantly impact banking.

- Banks are exploring blockchain technology in hopes of streamlining processes and cutting costs.

- Consumers can already see AI being used by most banks through chatbots in the front office.

- Banks are using AI to smooth customer identification and authentication while mimicking live employees through chatbots and voice assistants.

As technology advances and evolves, it brings many new and complex capabilities. However, this progress also presents a significant challenge when testing these technologies accurately. One particular area that poses difficulties is the emulation of human actions.

Comprehensive testing is necessary to identify any potential vulnerabilities or flaws.

Conclusion

Mobile banking apps demand rigorous testing to ensure security, performance, and seamless customer experience. With rising cyber threats and evolving regulations, banks must adopt a comprehensive testing strategy that covers security, functionality, performance, and accessibility.

BrowserStack’s App Live and App Automate provide a cloud-based, real-device testing solution that enables manual and automated testing across diverse devices, OS versions, and network conditions—without the need for in-house infrastructure. By integrating robust testing tools early in the development lifecycle, financial institutions can enhance security, streamline performance, and deliver a flawless digital banking experience with confidence.